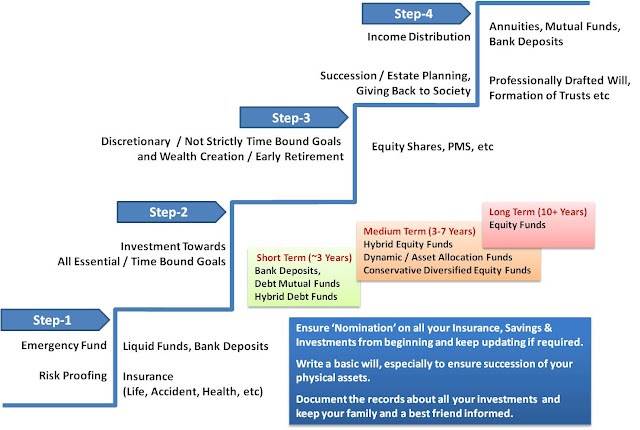

Simple & Effective Steps & Ways for Financial Success in your Life

Here is an attempt to present a complex subject (Personal Finance Management in simplest way without compromising on the core of the subject matter. Vast subject condensed to 4 Steps and further represented in one-page picture. Step-1: Create Emergency Fund and Get Insurance Covers Creating an Emergency Reserve Fund of at least your 3 months Salary / Income is your First Objective, as soon you start earning. Thereafter, it needs to maintained at that level in line with increase in your income. It needs to be recouped as soon as possible, when it gets used up. The reason why you should ever touch this money for spending is strictly an Emergency Situation (Ex: Medical Emergency, Loss of Job etc). This emergency Fund may be parked in a instrument that is quickly liquidatable; Investing in Bank Fixed Deposits and Mutu Fund Liquid Funds is most appropriate. Insurance is a next sub-step; A well rounded Insurance covers against untimely death (Term Insurance), Accidental Disab...